Navigating New York’s Short-Term Rental (Airbnb) Tax Changes

When New York State and Suffolk County implemented updated short-term rental regulations, the headlines focused on an “Airbnb tax change,” but the rules apply to every reservation, regardless of channel.

On March 1, 2025, the state implemented new tax collection and compliance requirements that affect Airbnb, Vrbo, Booking.com, smaller online travel agencies (OTAs), direct bookings and real estate agent brokered stays. The shift created understandable uncertainty for homeowners trying to determine how the rules applied across all reservation sources.

Most owners were left asking:

- Did the platforms collect correctly?

- Do I still need to remit anything?

- How do the new rules affect direct reservations or real estate agent brokered rentals?

Luxury Beach Getaway anticipated these changes early. Our role extends beyond property management; we help safeguard each home’s revenue and provide clarity so owners can rest easy.

The Change

New York State harmonized short-term rental tax collection across counties, establishing clearer rules about who collects and remits both state and local taxes. Under the updated structure:

- New York State sales tax applies to all short-term rentals unless a guest becomes a permanent resident after 90 consecutive days.

- Suffolk County occupancy tax applies to stays under 30 days.

These thresholds often get mixed together, so we separate them for owners from the start.

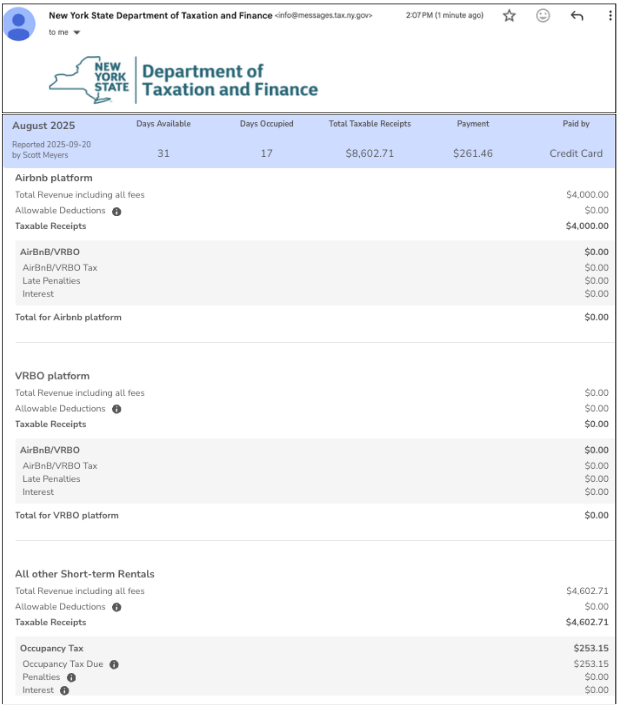

Only Airbnb and Vrbo currently collect and remit taxes automatically, and even then, the rollout has not been consistent. Airbnb and Vrbo collected correctly in some cases and missed or misapplied taxes in others during the transition. Booking.com does not collect or remit taxes at all, and the same is true for most smaller OTAs.

Direct bookings and real estate agent brokered rentals always require owner or manager collection and remittance.

The Risk

Tax collection gaps create real exposure for homeowners because:

- The owner is ultimately responsible for all taxes owed, regardless of OTA errors

- Platforms have been inconsistent during periods of regulatory change

- Missed filings or under collection can trigger penalties or audits

- Direct and agent-brokered bookings require full collection by the property owner or manager

- Incorrect tax treatment for long stays or exemptions can lead to back taxes and fines

Luxury Beach Getaway stays informed so homeowners don’t have to navigate these challenges alone. We make sure no channel, guest type or booking source creates a blind spot.

How Luxury Beach Getaway Responded

We prepared early for the March 1, 2025 cutover. As part of that preparation, we:

- Audited every booking across every channel

- Identified under collection and corrected discrepancies

- Reviewed bookings for potential under collection and addressed discrepancies appropriately

- Coordinated with tax advisors to confirm interpretations

- Updated internal systems and templates to reflect the new thresholds

Each homeowner received clear communication about what changed and how it affects their property. Behind the scenes, every transaction is verified and reconciled with precision.

Homeowners trust us to fill calendars and protect what matters most: their investment, their reputation and their time.

“Our owners don’t have to lift a finger. Every booking is reviewed, reconciled and documented so owners have clear and accurate records throughout the process.”

— Scott Meyers, Owner, Luxury Beach Getaway

Curious if Your Rental Is Fully Compliant?

If you’re unsure whether your short-term rental setup aligns with New York State and Suffolk County tax rules, Scott can personally review your process and explain how LBG manages tax awareness, OTA reconciliation and documentation within our operations.

During this review, we highlight where we could help simplify your approach and strengthen accuracy and transparency, without offering specific tax guidance.

Please Note

This article is provided for general informational purposes only and should not be considered tax, legal or financial advice. Readers should consult a qualified professional for guidance specific to their situation.

These New York State and Suffolk County tax rules are generally separate from local zoning or minimum-stay enforcement rules — including Riverhead’s recent expansion of short-term rental enforcement authority. Local enforcement actions typically do not change whether state taxes are owed, and state tax rules do not determine whether a stay is permissible under local law.